Note to Clients:

Please be informed of the upcoming adjustments to China’s export tax rebate policy for photovoltaic and battery products as detailed above. Key changes include the cancellation of the VAT rebate for photovoltaic products and a reduction followed by cancellation of the rebate for battery products.

Considering these policy changes taking effect from April 1, 2026, we kindly advise that if you have any purchase intentions, it would be beneficial to proceed with orders promptly to utilize the current, more favorable tax rebate rates.

Should you have any questions or wish to discuss potential orders, please do not hesitate to contact us.

—

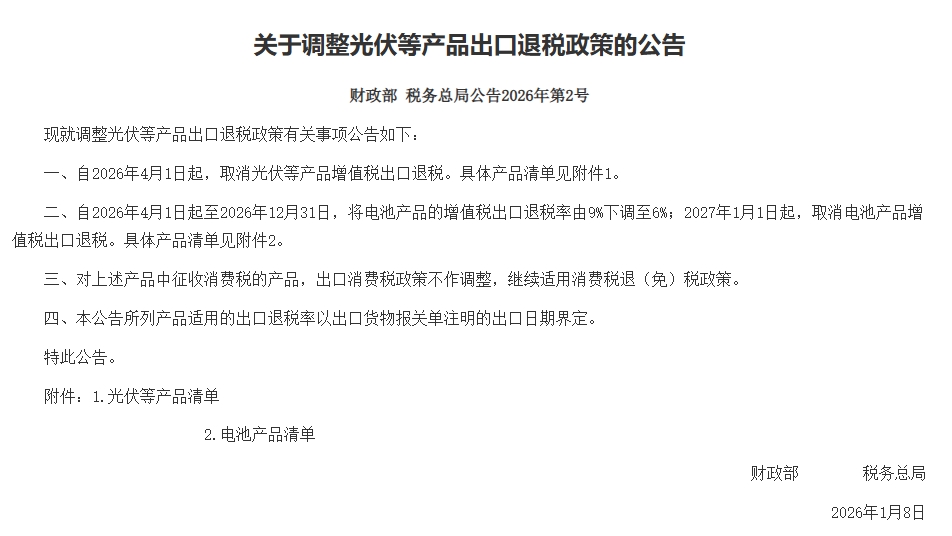

Announcement No. 2 [2026] of the Ministry of Finance and the State Taxation Administration

This announcement is issued regarding relevant matters for adjusting the export tax rebate policy for photovoltaic and other products, as follows:

1. The value-added tax (VAT) export tax rebate for photovoltaic and other products will be cancelled, effective April 1, 2026. The detailed product list is provided in Appendix 1.

2. The VAT export tax rebate rate for battery products will be reduced from 9% to 6%, effective from April 1, 2026, to December 31, 2026. The VAT export tax rebate for battery products will be cancelled, effective January 1, 2027. The detailed product list is provided in Appendix 2.

3. For products subject to consumption tax among the aforementioned products, the export consumption tax policy remains unchanged and will continue to be applicable for consumption tax rebate (exemption).

4. The export tax rebate rate applicable to the products listed in this announcement shall be determined based on the export date indicated on the Export Goods Declaration Form.

This announcement is hereby issued.

Appendices:

1. List of Photovoltaic and Other Products

2. List of Battery Products

Ministry of Finance, State Taxation Administration

January 8, 2026